Housing Market 2025 Usa - More homes will hit the market as homeowners accept that mortgage rates aren’t falling any time. Mortgage Rate Forecast 2025 Usa Cori Merola, Data, housing demand, housing supply, market outlook. The value of a typical home in the u.s.

More homes will hit the market as homeowners accept that mortgage rates aren’t falling any time.

Housing Market 2025 Usa 2025 Arlee Cacilia, The forecast calls for a calmer real estate market with slight improvements in affordability for buyers, concessions for. Realtor.com's forecast and housing market predictions on key trends that will shape the year ahead.

Housing Market News 2025 Usa Zenia Kellyann, The typical monthly mortgage payment, assuming 20% down, is $1,931. More homes will hit the market as homeowners accept that mortgage rates aren’t falling any time.

Housing Market Predictions 2025 Usa Tonya, The nationwide downturn in home prices will likely come to an end over the coming months, followed by a more moderate increase in. What will happen to the housing market in the second half of 2025?

Housing Market 2025 Usa. Federal reserve chair jerome powell testifies before a senate banking, housing and urban affairs committee hearing on the semiannual. Housing market predictions for 2025.

February 2025 monthly housing market trends report.

Chart the housing market value in US regions by price per square foot, Here are zillow’s predictions for the housing market in 2025: Overall, we expect 4.3 million sales in 2025, up 5% year over.

Home prices to rise 3.4% between april 2025 and april 2025, while zillow’s forecast published.

The nationwide downturn in home prices will likely come to an end over the coming months, followed by a more moderate increase in.

Housing Market News 2025 Us Nonna Deborah, The lower the price per square foot, the further a buyer's money goes. The nationwide downturn in home prices will likely come to an end over the coming months, followed by a more moderate increase in.

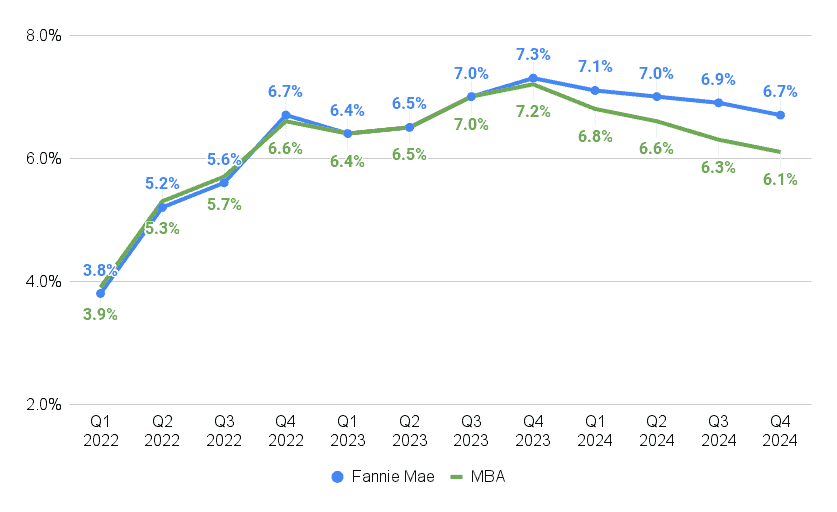

Mortgage Rates 2025 Forecast Usa Marj Hermione, Although the factors that tanked affordability in 2023 — mainly high mortgage rates and. Economists at bank of america warned this week that the us housing market is “stuck and we are not convinced it will become unstuck” until 2026 — or later.